It is important to get debt secure before you make significant investments in stock market or other venues. Note here I do not say “debt free” but rather “debt secure”. It means not all debts are born equally. The concept that you have to get rid of any debt is not true.

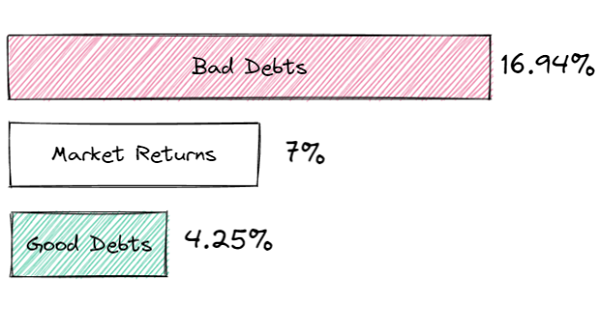

Some debts are bad that drain your wealth over time. On the other hand, you may take advantage of some good debts if your cash flow can cover the interests. The difference is mainly due to the interest rates of debts compared to the returns you can achieve in your investments.

Bad Debts

Credit cards, personal loans, etc. are bad debts. They have extremely high interest rates. You will never be able to fill the hole if you only pay the minimum every month. Credit cards interest rates can be as high as 30%. Personal loans, where there are little as collaterals from borrowers, can be incredibly high as well.

Pay them off as soon a you can. Do not put any of your money into stocks or any sorts of other investments before you pay them off. No investment returns can reach 20-30% in long term to justify not paying those bad debts off.

Good Debts is Key for Debt Secure

In this low interest environment, the mortgage interest rates are at historically low. In fact, real estates refinancing jumped 105% in 2020 as 30-years fixed-rate mortgages tumbled further below 3% this year.

A few of my friends refinanced as well. However, they still rush to pay off the refinanced debt as soon as they can. What is the rush? Even with historical high stock market, the after tax return can still easily beat 3%. That is not considering all the benefits mortgage reduction will bring to you.

As a matter of fact, refinance has been an open secret in real estate investing. Once the value of a property has gone up, investor can refinance the existing debt to take the equity out.

TAX FREE!

And investor can continue to enjoy the property’s appreciation after refinancing. Over and over again.

In summary, do not pay off your mortgage as long as you have a low enough interest rate. I understand some people like to be completely debt free to give themselves a peaceful mind. However that is a very conservative attitude. An average investor, who is willing to take reasonable bets, should just use the extra capital to grow more fast in stock market instead of paying off the debt.

The same arguments can apply for student loans. If the interest rate is low enough (<3%) and you do not have a deadline to pay it off, invest the money wisely instead. Note here to invest, not to spend. If you expense the money, you might as well just pay off your student loan.

Credit Card Promotions

A lot of credit card nowadays provides a certain period of 0% interest rate. You will have to pay off the whole debt before the promotion periods end. Otherwise you will be paying the interest of the whole promotion period once the promotion ends.

I usually apply for a new credit card with 12 to 18 months of 0% promotional rate. Then I spend on this card and gradually pay the whole debt off before the promotion ends.

That will hurt the credit score a bit for applying a new card. But if you are not in a process to buy a house or borrow money from other source, it is good way to spend your good credits.

Investing is a time game, generally speaking, the earlier you invest, the more return you will have. This credit card trick help you front load some cash today to invest it early. However, make sure you have enough liquidity to pay this off before the promotions end.

You can also apply for a new 0% interest rate card with promotion when you current promotion period is ending. Pay off the current card and expense on the new card. Note that it is better not to do balance transfer – there is always at least a minimum 3% transfer fee associated with it. Use some emergency fund or other short term liquidity to cover the debt transferring process manually and continue to enjoy the 0% interest rate on credit cards.

Keep Debt Secure with Liquidity

As a conclusion, take advantage of good debts and avoid bad debts. However in any case, reserve sufficient savings to pay off incoming debt responsibilities, no matter good or bad, to stay debt secure. In most cases it is probably not necessary to keep cash to cover the entire good debt but to pay interests and any maturing good debts.

View here for more personal finance posts.

Disclaimer: The information contained on this site is provided with author’s personal opinions and is not for recommendations or solicitations of investments. Readers should consult professional advisors for more complete and current information to make investment decisions.